Bitcoin could reach new all-time highs within a few weeks, according to a recent analysis by the CryptoQuant team. The NVT Golden Cross indicator, which measures the value of the network in relation to transactions, shows that the price of BTC still has room to climb. And this indicator has already accurately predicted upward movements in the past.

The NVT Golden Cross: an indicator to watch

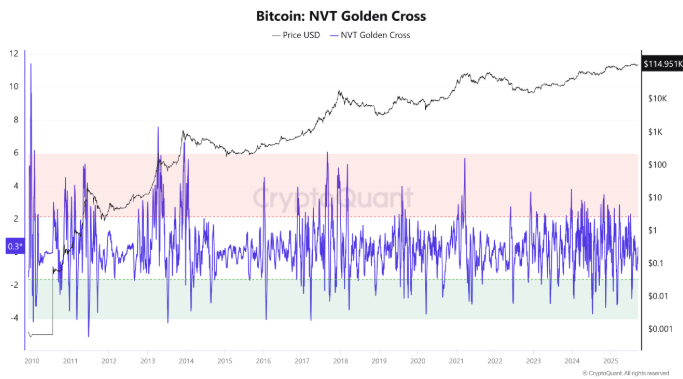

The NVT Golden Cross Indicator (NVT-GC) compares Bitcoin’s market cap to the value of transactions on the blockchain. It helps determine whether BTC is overvalued or undervalued. Currently, this indicator is in neutral territory, which means that the price of Bitcoin is neither too high nor too low.

According to CryptoQuant, when the NVT-GC is negative, it usually indicates a period of upside ahead. Conversely, a positive NVT-GC signals a possible correction. In July, the NVT-GC was at -2.8, a strong buy signal. Today, it is at 0.3, suggesting that BTC still has room to advance.

A new high for Bitcoin by October?

CryptoQuant is not the only one to be optimistic. Axel Adler Jr., another analyst, believes that BTC could enter the price discovery phase by October. It is based on the STH MVRV Z-Score, another indicator that measures the ratio between market value and realized value.

According to him, this STH MVRV Z-score is close to zero, which indicates that the market is balanced. “The price of BTC is just above the realized price in the short term, which sets the stage for 1-2 weeks of consolidation with a potential push towards a new ATH,” he said.

In summary, all the lights seem to be green for Bitcoin. Whether it’s the NVT Golden Cross or the STH MVRV Z-Score, indicators show that BTC still has potential and that we could be heading towards an Uptober that everyone is waiting for and hoping for.