AJC, research manager at crypto analytics firm Messari, sparked a heated debate on X over the weekend after declaring that Ethereum is “dying.”

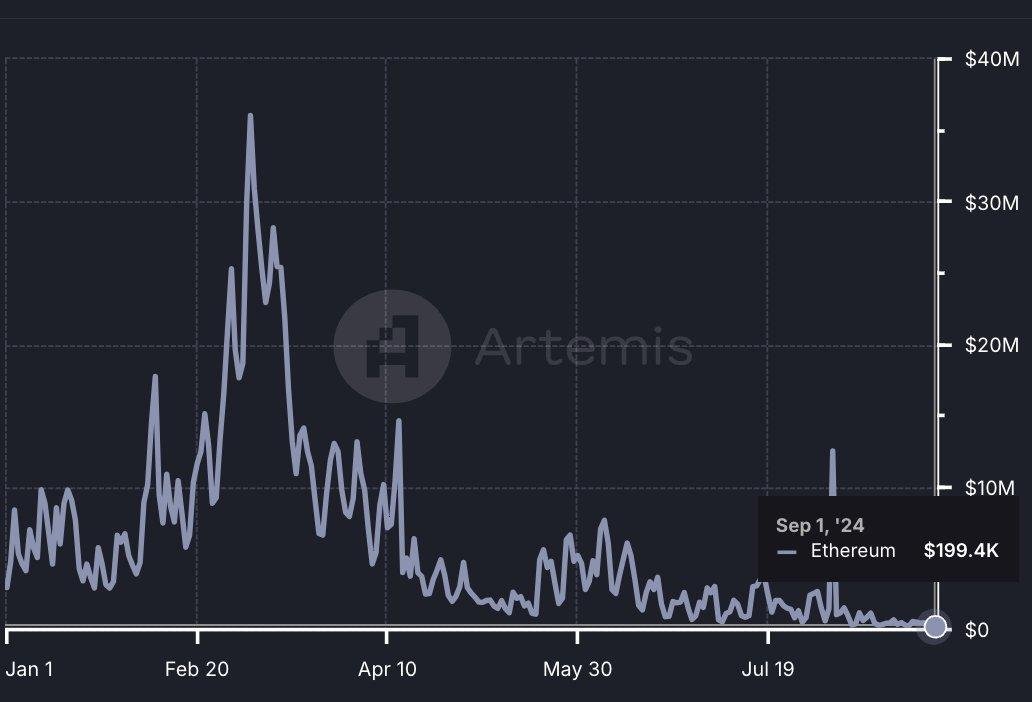

In his post, he stated that “Ethereum’s fundamentals are collapsing,” as network fees in August totaled just $39.2 million. This represents a decline of over 40 percent year-on-year and about 20 percent month-on-month.

ETH bulls pointed to rising metrics such as app revenue, the number of active addresses and transactions, and improved Layer 2 scaling.

Henrik Andersson, Chief Investment Officer at investment firm Apollo Crypto, also believes Ethereum is unlikely to die. He argues that it is still “a vibrant ecosystem, with stablecoin supply, throughput, and active addresses at or near all-time highs.”

AJC counters: App revenue is driven solely by Circle and Tether, while the other KPIs don’t directly impact the value of ETH and are therefore irrelevant in this context.

The crypto expert defended his use of revenue to value the Layer-1 blockchain, arguing that revenue is the biggest driver of ETH demand and that it “tends toward zero.”

His opponents, however, argue that Ethereum, like Bitcoin, should be valued as a commodity and not a tech stock—and thus not based on revenue.

The discussion surrounding the “monetary premium” of Layer-1 tokens like ETH and SOL is an ongoing point of contention in the crypto community.

The narrative in favor of a high valuation is currently being undermined by corporate chains from Google, Stripe, and others. Circle’s Arc, for example, will use USDC instead of ETH for transaction fees.

A large part of Ethereum’s decline in revenue can be attributed to the Dencun upgrade in March 2024, which massively reduced transaction fees for Layer 2 networks.