The price of bitcoin (BTC) is modestly lower during U.S. trading hours on Friday, but at its current $26,300 is ahead about 2% from week-ago levels.

The crypto began the week with sizable losses, dipping below $25,000 for the first time since mid-June over worry bankrupt crypto exchange FTX was soon to begin unloading all of its digital assets, which included more than $500 million worth of bitcoin.

While FTX did receive court permission to begin selling, the sales will be at a measured pace and unlikely to cause any quick tumbles in crypto markets.

Bitcoin (BTC) price crash averted, but rallies continue to be sold

The overarching theme in bitcoin and crypto in general for nearly four months now is the speed with which even modest moves higher get reversed.

As the FTX news this week demonstrates, while at the moment there don’t appear to be any entities interested in a full-scale dumping of digital assets on the market, there remain numerous sellers looking to take advantage of rallies.

In addition to FTX, consider other impaired trading firms, lenders, and exchanges, as well as bitcoin miners – many of whom one year ago were confirmed hodlers, but now must sell at least part of their bitcoin stash each month to help fund their operating expenses.

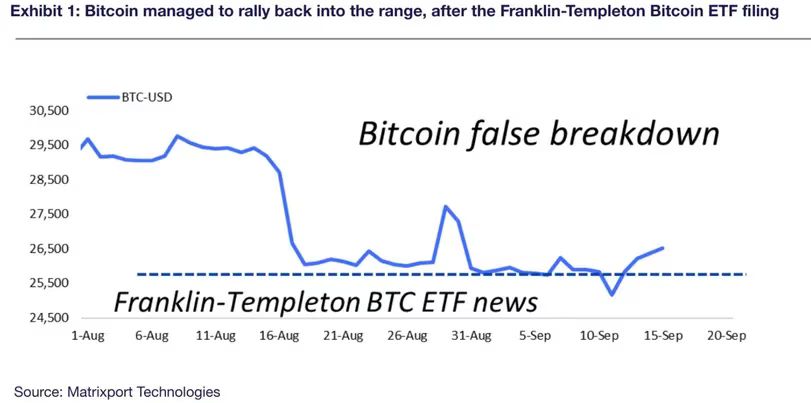

Despite the selling pressure, this week’s positive news about asset management giant Franklin Templeton joining the race to list a spot BTC exchange-traded fund (ETF) and global lender Deutsche Bank delving deeper into digital asset custody and tokenization might backstopped prices, rendering Monday’s breakdown a false signal, according to crypto service provider Matrixport.

“The Franklin Templeton-news was released as prices neared $25,100, coinciding with when the market became aware of BlackRock’s Bitcoin ETF filing in June,” Matrixport noted in a market update on Telegram. “Hence, this $25,000 level is of the utmost importance now, and appears to be fortified by news affecting prices.”

Bitcoin reclaiming the previous trading range and consolidating at these levels was a “promising sign,” according to Rachel Lin, CEO of derivatives decentralized exchange SynFutures.

“BTC is currently in the process of converting the $26,000 level from resistance to support,” Lin said in an emailed note. “Until Wednesday, every attempt at breaking above this level resulted in heavy selling. If BTC stays above $26,000 by the end of the week, it could be a positive sign, at least in the short term.”

While bitcoin consolidated, the rest of the market showed signs of weakness. The CoinDesk Market Index (CMI), which tracks the performance of a broad basket of digital assets, only gained 0.8% over the past seven days, the CoinDesk Bitcoin Price Index (XBX) outperformed and was up 1.7%.

Among CoinDesk’s sectorial indices, the Culture and Entertainment sector (CNE) performed the worst with 3.2% loss in a week, followed by the DeFi sector (DCF) declining 1.6%.

“Unfortunately, the broader crypto market is not as strong as BTC,” Lin said. “Their fall on Monday was bigger than BTC, and their bounce back was weaker. This led to the previous week’s support level of 515-520 billion [market capitalization] turning into resistance.”

Apecoin (APE) was one of the week’s biggest loser, dropping near 18% in a week ahead of its major token unlock due this Sunday. The event will release $43 million worth of tokens, giving early investors a chance for selling.

“Trading BTC long and strategically selling altcoins, particularly those with event-related risks like ApeCoin, has the potential to generate significant alpha,” Matrixport advised.