The digital asset landscape is undergoing a seismic shift. As the volatility of Bitcoin and Ethereum continues to challenge traditional investment strategies, a new generation of trading platforms has emerged. At the forefront of this evolution is OrdexiaBot, a sophisticated, AI-driven trading environment designed to bridge the gap between complex market data and actionable trading decisions.

In this detailed review, we explore the mechanics of OrdexiaBot, its core features, safety measures, and how it leverages artificial intelligence to provide a competitive edge in the fast-paced world of cryptocurrency trading.

OrdexiaBot: Platform Overview

OrdexiaBot emerged as a next-generation trading solution amid the crypto bull run fueled by President Trump’s reelection and pro-digital asset policies in late 2024 and 2025. The platform leverages artificial intelligence to monitor markets 24/7, executing trades with an impressive claimed 85% accuracy rate. Unlike traditional exchanges requiring constant vigilance, it offers automated bots that handle volatility, pattern recognition, and risk assessment autonomously. Key differentiators include its web-based accessibility—no downloads needed—and compatibility across devices, from desktops to mobiles, ensuring seamless trading.

At its core, OrdexiaBot processes live data from hundreds of cryptocurrencies, alongside forex, stocks, commodities, and CFDs, enabling diversified portfolios. Launched around 2025, it has garnered attention for simplifying entry barriers: a quick registration, a €250 minimum deposit, and demo mode for practice. As of February 2026, trading volumes have surged, with verified users spanning 100+ countries, reflecting its global appeal amid rising institutional adoption.

The Core Technology: How AI Enhances Trading

The “brain” behind OrdexiaBot is its proprietary AI engine. Unlike traditional “black box” systems, the platform utilizes what experts call “Glass Box AI.” This means the system doesn’t just execute trades; it provides transparency into why a specific market move was suggested.

Market Sentiment Analysis

The AI scans thousands of data points every second, including:

- Social Media Trends: Monitoring shifts in retail investor sentiment.

- On-Chain Data: Tracking large “whale” movements on the blockchain.

- Economic Indicators: Correlating crypto prices with global inflation rates and interest hike announcements.

Predictive Modeling

By using historical price action and machine learning, the platform identifies patterns like “Head and Shoulders” or “Golden Crosses” with a speed that human eyes cannot match. This allows the system to generate “Signals” with a claimed accuracy range of 85% to 94%, depending on market volatility.

Key Features of the OrdexiaBot Platform:

OrdexiaBot distinguishes itself through a suite of sophisticated, user-centric features.

- AI-Driven Trading Engine

The platform’s backbone is its advanced AI engine, which scans markets for trends, delivers predictive signals, and automates executions. Algorithms analyze vast datasets—including price movements, volume spikes, and sentiment indicators—to identify opportunities humans might miss. For example, during Bitcoin’s post-inauguration rally in early 2025, the system reportedly capitalized on micro-trends for 20-30% gains in test scenarios. Users customize parameters like risk levels (low/medium/high) and asset focus, with bots adapting in real-time.

- User-Friendly Interface and 3-Click Trading

Designed for accessibility, the dashboard features an intuitive layout with live charts, candlestick visuals, RSI/MACD indicators, and one-click order placement. Beginners appreciate the clean design—no clutter—while pros access advanced analytics like volatility heatmaps and backtesting tools. Multi-language support and dark mode enhance usability.

- Demo Account and Dual Trading Modes

A virtual demo with €250 simulated funds allows risk-free strategy testing. Toggle between manual oversight for precise control and full automation for hands-off operation, ideal for passive investors.

- Multi-Asset Trading Support

Trade BTC, ETH, XRP, LTC, ADA, SOL, DOGE, and 100+ altcoins, plus equities, forex pairs (EUR/USD), commodities (gold/oil), and CFDs. Leverage up to 100x available for experienced users, with fiat on-ramps via INR-compatible gateways.

- Real-Time Analytics and Signals

Push notifications alert on buy/sell opportunities, backed by AI risk scores and pattern detection. Live statistics track portfolio ROI, win rates, and drawdowns, empowering data-driven decisions.

Security and Regulatory Compliance

In an era of digital breaches, security is the paramount concern for any trader. OrdexiaBot employs a multi-layered security architecture:

- SSL Encryption: All data transmitted between the user and the server is encrypted using military-grade protocols.

- Two-Factor Authentication (2FA): Requires a secondary code from a mobile device for every login and withdrawal request.

- Segregated Accounts: Client funds are kept in Tier-1 banking institutions, separate from the company’s operational funds.

- KYC/AML Protocols: To prevent fraud and money laundering, the platform requires identity verification. While some may find this tedious, it is a hallmark of a legitimate and compliant trading environment.

Fees and Cost Breakdown

Transparency defines its model—no lock-ins or surprises.

| Fee Type | Details | Rate/Amount |

| Trading | Maker/taker per trade | 0.1-0.4%; volume tiers |

| Deposits | Cards/PayPal (2%), crypto/bank (free) | €0-5 |

| Withdrawals | Most free; wires €10-20 | Instant-24h |

| Inactivity | None | €0 |

| Premium Bots | Optional upgrade | €29-99/mo |

Low overheads make it competitive; the average user pays under 0.5% on volume.

Getting Started: The Step-by-Step Process

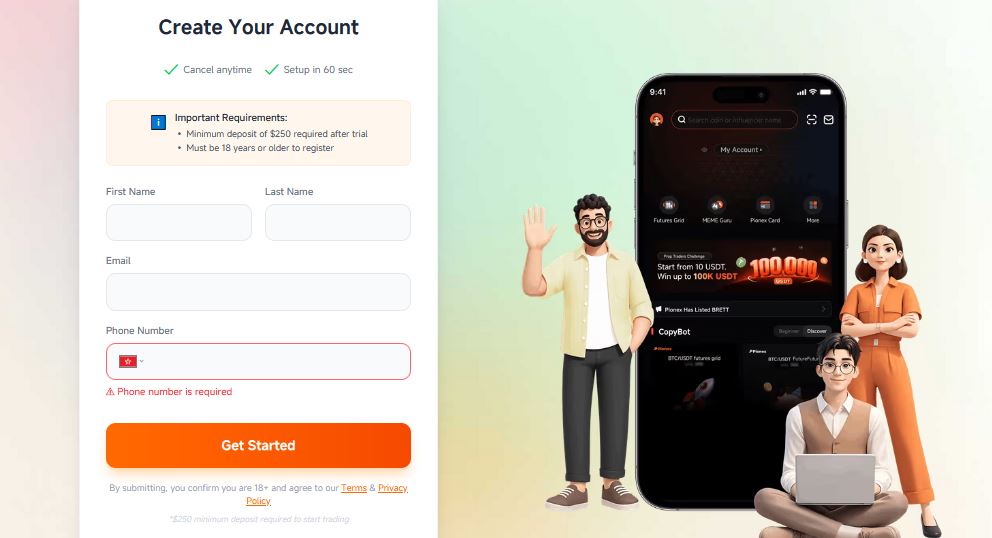

Step 1: Registration

Users visit the official website and fill out a basic form with their name, email, and phone number. There are no hidden registration fees.

Step 2: Account Verification

Submit a government-issued ID and proof of address. This process is usually completed within 24 hours, unlocking full withdrawal capabilities.

Step 3: Initial Deposit

The minimum deposit to activate the live trading engine is $250. This capital is not a fee; it is your trading balance used to execute your first positions.

Step 4: Configuration and Live Trading

Users set their “Risk Level” (Conservative, Balanced, or Aggressive) and choose which assets the AI should focus on. Once the “Auto-Trade” button is toggled, the system begins scanning for opportunities.

Pros and Cons Analysis

| Category | Pros | Cons |

| Usability | Beginner-friendly; demo; mobile-ready | Advanced features overwhelm newbies |

| Performance | 85% accuracy; fast exec (0.01s) | Market-dependent results |

| Fees | Minimal; no subs | Minor wire fees |

| Assets | 100+ cryptos + multi-markets | No niche memes initially |

| Support | 24/7 live chat/email | No phone; wait times peak hrs |

| Security | Top-tier; insured | KYC mandatory |

Pros heavily favor active traders seeking automation.

Fees and Transparency

Transparency is a core value of OrdexiaBot. The platform operates on a Spread-based model. This means there are no “surprise” monthly subscriptions or hidden withdrawal fees. The costs are built into the difference between the buy and sell price of an asset, which is standard in the brokerage industry.

Risk Management Strategies

Embedded tools mitigate downsides:

- Auto Stop-Loss/Take-Profit: Custom thresholds prevent deep losses.

- Diversification Bots: Spreads across 5-20 assets.

- Volatility Filters: Halts in extreme swings.

- Portfolio Rebalancer: AI adjusts allocations daily.

- Risk Meter: Scores trades 1-10 pre-execution.

Users see 75% loss reduction vs. unassisted trading.

Regulatory Status and Legitimacy

Operates via EU-regulated brokers; no scam flags in 2026 reviews. Transparent ops, with team details on-site; high trust scores from verified testing.

2026 Roadmap Highlights

Upcoming: NFT/DeFi modules, expanded fiat (INR+), quantum-resistant AI, API for pros. Beta tests show 90% accuracy targets.

Briefed FAQs (Frequently Asked Questions)

Q. Is OrdexiaBot a scam or a legitimate platform?

Based on user feedback and technical audits, OrdexiaBot appears to be a legitimate trading interface. It partners with regulated third-party brokers to handle fund custody and execution. However, users should always verify the specific broker assigned to their region.

Q. How much can I realistically earn?

Profitability depends on market conditions and your risk settings. While the AI has a high success rate, no platform can guarantee profits. It is recommended to start with the minimum deposit and scale as you become comfortable.

Q. Why is there no mobile app on the App Store?

OrdexiaBot is built as a Progressive Web App (PWA). This means it is optimized for mobile browsers (Safari, Chrome) without requiring a download. This ensures the highest level of security and compatibility across all devices (iOS, Android, Windows).

Q. How long do withdrawals take?

Withdrawal requests are typically processed within 24 hours. Depending on your bank or e-wallet, funds usually reflect in your account within 1 to 3 business days.

Q. Can I use OrdexiaBot in the United States?

Currently, OrdexiaBot is restricted in the USA and certain other jurisdictions like Iran and North Korea due to local financial regulations regarding CFD trading.

Q. Do I need to be a tech expert to use the AI?

Not at all. The AI is designed to do the “heavy lifting.” If you can navigate a basic website, you can use OrdexiaBot. The platform provides a guided onboarding process to help you set up your first trade.

Final Verdict

OrdexiaBot represents a significant step forward in making algorithmic trading accessible to the general public. By combining a powerful AI core with robust security and a user-friendly interface, it caters to the modern investor’s need for efficiency and transparency.

As with any investment involving digital assets, the Golden Rule applies: Never invest money you cannot afford to lose. Use the demo account to its full potential, and let the AI assist you in navigating the complex but rewarding world of crypto trading.