Gold has been the undisputed number one asset in central bank vaults for centuries. With around 36,000 tons worldwide, the precious metal remains the ultimate store of value – and recently reached a new record high of $3,780 per troy ounce. But Bitcoin has also matured in recent years: Since the approval of spot ETFs in the US, billions have flowed into the market, volatility has dropped noticeably, and market capitalization is approaching historic highs. This begs the question: Does Bitcoin have what it takes to replace gold as a reserve currency by 2030?

Comparing Reserve Criteria

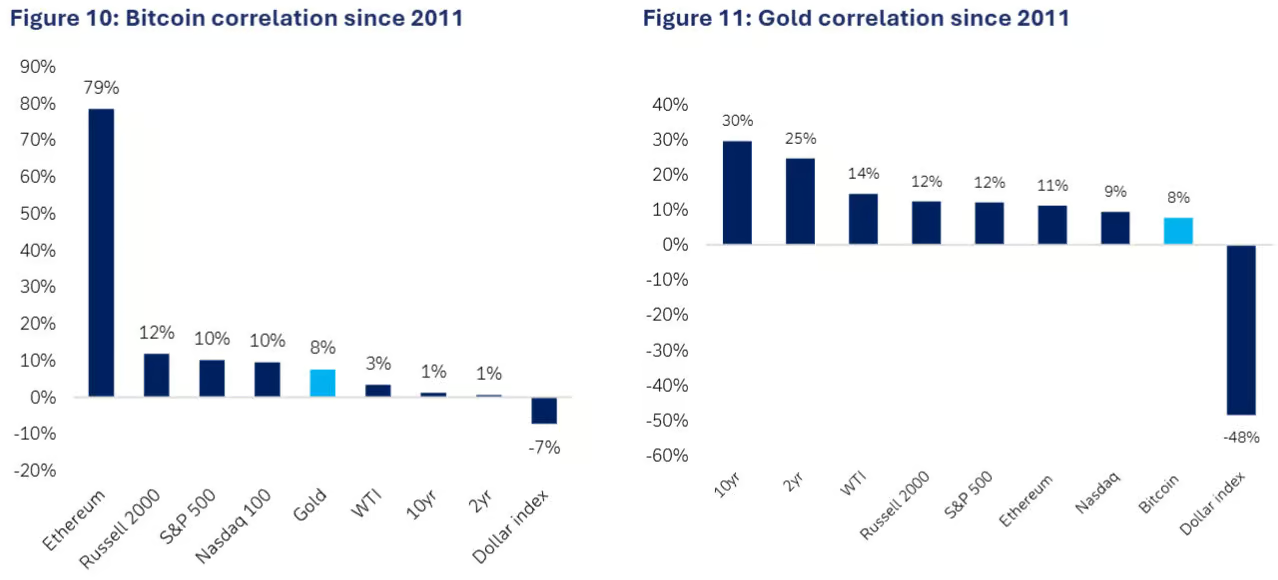

Both gold and Bitcoin share key characteristics: scarcity, the absence of counterparty risk, and low correlations to traditional asset classes. While the precious metal has built trust over centuries, Bitcoin is catching up thanks to increasing regulation, audited custody structures, and institutional products.

Particularly noteworthy: Even with record prices, 30-day volatility has fallen to historic lows in 2025 – a crucial signal for central banks focused on stability. However, trust in the digital version remains fragile, as legal standards and market mechanisms are not established in all regions.

Political Catalyst: USA

A potential game changer comes from the homeland of the US dollar. The US is currently debating the so-called “BITCOIN Act” – a legislative proposal that proposes building up government Bitcoin reserves and consolidating confiscated coins. The plan even includes the purchase of up to one million Bitcoin, which would correspond to around five percent of the total supply.

This could be financed through budgetary flows such as customs revenues, without the need to incur new debt. Furthermore, the draft stipulates a minimum holding period of 20 years before these reserves may be sold again. The proposal is politically explosive, but the debate alone sends a strong signal. If the largest economy and issuer of the reserve currency experiments with Bitcoin as a reserve, other countries will also be forced to rethink their strategies.

Bitcoin and the Lessons from Gold History

Despite declining volatility, Bitcoin remains a risky candidate for central bank balance sheets. While market infrastructure has improved, the cryptocurrency remains more vulnerable to abrupt price movements than gold. Trading platforms and custody service providers, in particular, are considered weak points, not the protocol itself. Added to this is the geopolitical dimension: While stablecoins are pegged to fiat currencies such as the US dollar, Bitcoin is not pegged and could therefore be viewed as a threat to dollar hegemony.

A look at the history of gold, however, shows that even the “safest” reserve asset was once characterized by strong fluctuations. Only with growing acceptance, clear regulations, and mature markets did the precious metal achieve its current stability. A similar process could be emerging for Bitcoin as well. Away from “boom-and-bust cycles” and toward a more stable, long-term upward trajectory. Neither gold nor Bitcoin will displace the US dollar anytime soon. But like gold, BTC could gradually evolve from a risky niche asset into a recognized diversification instrument.

Does Bitcoin have better qualities?

Central banks are institutions that typically rely on proven structures. Gold has a millennia-old history, is deeply embedded in the economy and society, and is still considered an undisputed reserve asset. Bitcoin, on the other hand, is still young, has yet to build trust, and is struggling with skepticism and unanswered questions.

At the same time, it offers properties that even put it ahead of gold: verifiable scarcity, decentralization, and the ability to transparently verify holdings – an advantage that minimizes the trust risk of traditional gold reserves. Bitcoin could therefore repeat gold’s path, but with better properties as a modern reserve asset in a digital world.